Noticias

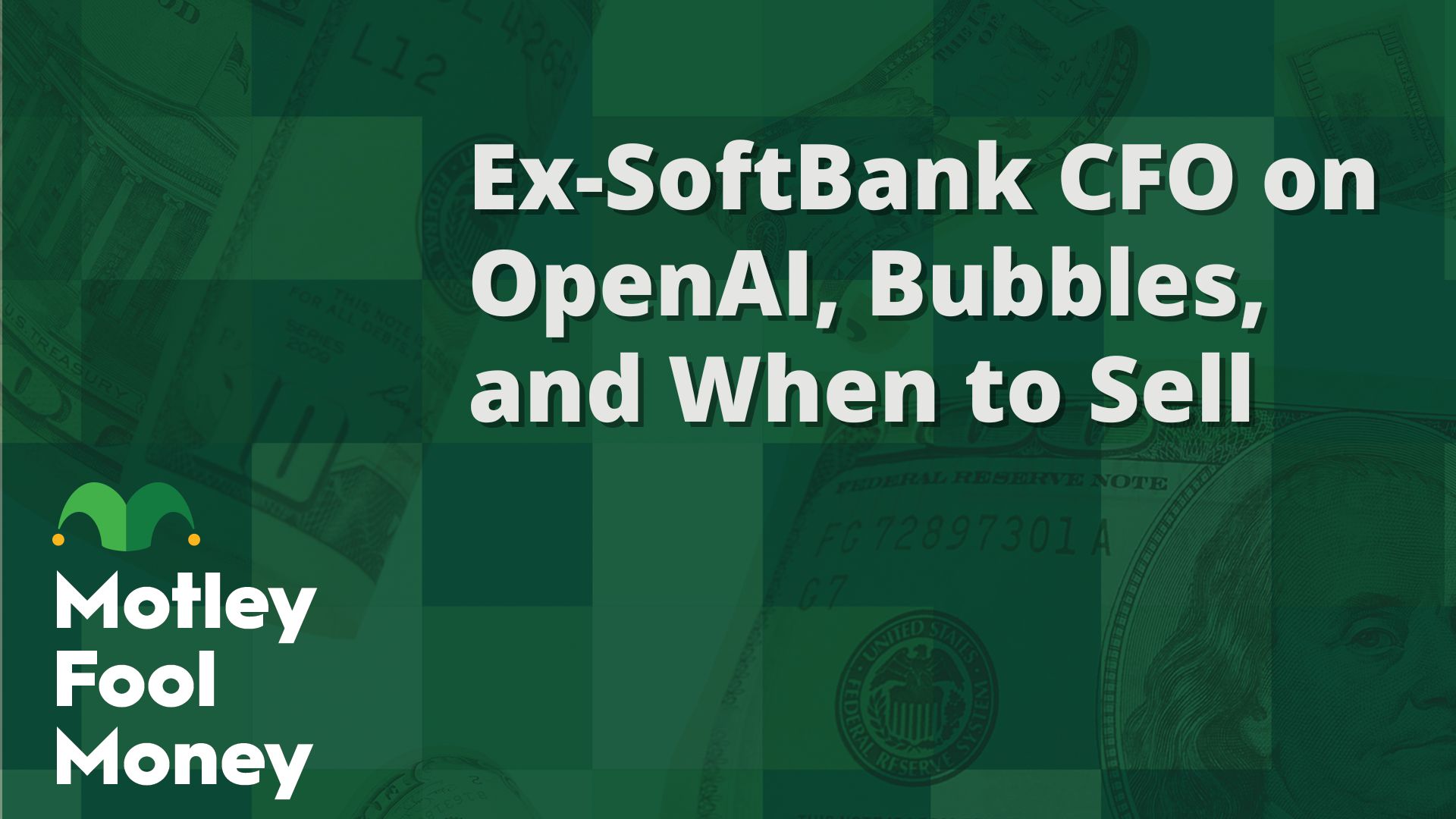

Author Alok Sama on OpenAI, Bubbles, and When to Sell

Published

1 año agoon

We’re talking tech.

Alok Sama is the former president and CFO of SoftBank Group International and the author of the new book The Money Trap: Lost Illusions Inside the Tech Bubble. In this podcast, Motley Fool host Ricky Mulvey caught up with Sama to discuss:

- OpenAI’s latest fundraising round.

- “Happiness for everyone” as an investment philosophy.

- The illusion — and reality — of power.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. To get started investing, check out our beginner’s guide to investing in stocks. A full transcript follows the video.

This video was recorded on Oct. 12, 2024.

Alok Sama: People often ask me you’re cynical about Silicon Valley, you’re cynical about Wall Street, but you seem to put Masa Son on a pedestal and that’s the reason. He had this quality that completely eludes me, and when he tells me that you’re not enough of a hunter, I get where he’s coming from. I don’t see what he does. I don’t see risk the way he sees it.

Mary Long: I’m Mary Long and that’s Alok Sama, former President and CFO at SoftBank International, and author of the new book, The Money Trap. Lost Illusions inside the Tech Bubble. SoftBank is a Japanese holding company that’s made big bets on some of the biggest names in Tech. Alibaba, ByteDance, Arm Holdings, also Uber, DoorDash, Lemonade, Opendoor, and a lot more. Some of those bets have paid off handsomely. Others quite the opposite. From 2014-2019, Sama was a top executive at SoftBank, where he worked closely with the firm’s founder, Masayoshi Son and had a front row seat as the company launched its legendary $100 billion vision fund. My colleague, Ricky Mulvey recently caught up with Sama for a conversation about the delicious circularity in AI markets. The difference between being a hunter and being a cook, what it means to live in the future, and knowing when to sell. Quick programming note before we get to today’s show. Since this conversation runs a bit longer than usual, we won’t be posting an episode tomorrow. Enjoy the day off Fools. We’ll see you again on Monday.

Ricky Mulvey: We’ll get into the book, but I want to start with this OpenAI news, because you’re comfortable talking about your former employer. You just wrote a book about them, and they’re back in the news with this investment in OpenAI. The nonprofit just raised $6.6 billion at a $157 billion valuation. SoftBank putting $500 million into the mix. What do you make of this valuation, this rise of OpenAI right now?

Alok Sama: Candidly, I think SoftBank investing 500 million is probably the least interesting aspect of the deal. You got to keep in mind as mind boggling as these numbers seem. SoftBank has when I last l close to 40 billion in cash, son signed his last AGM, talked about everything else he’s done previously is a warm up bag. You can put that together in the context of a man who’s been known for big, bold, audacious usually spectacularly successful moves. This is not his big moves, I guess. Let’s talk about OpenAI. To me, the question I get asked a lot is AI, is it overhyped? Are some of these valuations over hyped? When I see Safe Superintelligence, which is another company that raised pre-revenue. Forget about business model, just the concept from our OpenAI employee raising $1 billion. Is it a $5 billion valuation? OpenAI at 157 billion for a company that is bleeding cash, $5 billion from reports and beating people too. They lost their CTO and a whole bunch of people. You have to ask the question. A things getting overdone? Is there element of formal going on? I suspect in the private space there is because, unlike Google, for example, in its early days. with with OpenAI there’s real competition out there.

There’s Google for one, and getting AI right is existential for Google. Talk about deep pockets, Google’s got their own Gemini, LLM. You’ve got Facebook, again, with that monumental user base across its various platforms into Facebook Whatsapp, and they’ve got an open-source AI LLM out there. this competition, there’s real alternatives. Having said that, there’s no doubt, OpenAI is very real, first mover. Chat GPT has become almost synonymous with AI in the eyes of the world. There are strong traction in the enterprise user base. I I don’t argue with the fact that it’s worth a ton. I just wonder about a 150 billion number as I do about 5 billion for Safe Superintelligence for a company, that’s just belly on a concept. That to me and it’s a good thing this stuff is going on in the private markets because I’ve lived through inflated valuations 2000. You had these sorts of things going on in the public market at that point in time.

There are other aspects of OpenAI. Sorry, I’m branding on a little bit, I just find this so interesting that. The other thing that’s really interesting about OpenAI, is you’ve got five capital leading this round. They led the previous round, so they get to mark up the deal in the books at 2X. That’s unusual in VC Lane. People don’t very often do that. You’ve also got investors to the investors who are participating are Microsoft and NVIDIA. Guess what? OpenAI does with the money they raise. They take the cash, and they buy capacity on Microsoft Cloud. The money goes to Microsoft. What does Microsoft do with the money? Well, it buys NVIDIA chips. The money goes to NVIDIA. There’s almost a delicious sort of circularity. It’s a little bit incestuous too. There’s a lot going on in that deal and as great a company as it is, and Sam Ortman, terrific entrepreneur and obviously, a fundraiser and a salesman, too. I think there’s a real risk when you start extrapolating that valuation as people often do in terms of other things going on in the private and the public space.

Ricky Mulvey: What do you think that valuation is based on then? That $157 billion?

Alok Sama: I think that’s my point. I don’t know. Having said that, I’ve been in tech Investment land, and frequently, in my book, I tell the story of how Son, Sam and I have dinner with Mark Zuckerberg, and the one thing that came through to me loud and clear, is Masa’s regret, even pay a not investing in Facebook at a $10 billion valuation and I dare say when Facebook was served up at 10 billion, you and I might have had the same discussion or not come up with an answer, which is what is that 10 billion based on? Look that’s frequently the case with technology. Relatively early stage technology investments. It’s just very difficult to hang your hat on a specific valuation number. There is a huge leap of faith involved, and you take the view that look, there’s an asymmetric payoff. this thing from 150, it could be worth over 2 trillion the way NVIDIA is or Facebook is, right? That’s the only sensible response I can give you. There is no conventional valuation metric that would, as I sit here today, give me enough time to make something up, but I can’t come up with something on the spot of the moment.

Ricky Mulvey: In your book, you talked about these early stage companies, where they don’t have cash flow and that’s often that is what you value companies on, so you have to move to something like, what would it be gross merchandise value or the total amount of sales going on in an online marketplace and not necessarily the cut or the profit even that a company is being taken from that. We’re seeing a lot for the retail investors listening. What what are the company metrics that sort of set off your BS meter for these young emerging exciting companies?

Alok Sama: I think too much of an emphasis on revenue multiples, for example, you talked about GMV. There was a real heart button. GMV is gross merchandise value and, in the context of an e commerce company. you buy something on Amazon for 100 bucks. That’s the gross merchant value. Amazon’s cut of that might be, five or 10%. That’s Amazon’s revenue. You could have a huge GMV and not make any money at all. the 10% is revenue, and then there’s cost. When I see people extrapolating of revenue multiples into infinity, and the profit is a complete leap of faith, I start scratching my head. That to me is is a bit of a red flag. I don’t call it a BS. I think that’s way too strong. I think OpenAI is very real. It’s going to be worth a lot. I just don’t know how much, and I don’t know how to value it.

Ricky Mulvey: You’ve been a part of multiple bull cycles, and your book covers being a part of those, and people go with the herd. They react as if I’m not going to quote directly, but people react as if they’re on drugs when they’re part of these mad herds running toward these evaluations, and for us listening, you’d expect you’d expect the bankers to react as you right? Like, Mr. Spock evaluating these investing decisions with very cold, hard analytical skills. That doesn’t seem to be the case. It seems that emotions continue to rule no matter where you are in the investing spectrum.

Alok Sama: I think that’s always going to be the case. I think 300 years. Book I talked about this wonderful example of this book written by the Scotsman Charles Mackay. I think it was written in the 18th century and this guys like isit’s considered to be, like the ultimate authority on bubbles. He talked about. People might have heard of tulips in Meerland, and how ridiculous that became right there. But but this guy missed the biggest bubble in his own lifetime, which was railroads in England. Those of you might have watched Dan and abbey. Lord Grantham, that’s how he lost his shirt on [laughs] Railroad. This has been documented for a long time and I got to tell you I’ve been in and out of these markets for lost at this point, man, I’m showing my age almost 40 years. I get caught up, too. Everyone goes free.

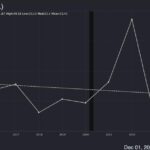

But I tell you, the one thing that is it’s good, and this is actually really useful to talk about is to the extent there’s frat, a lot of that is in the private markets and not the public markets. The big difference relative to the Internet bubble is the hype at the time was in public markets. You had companies pre-revenue, going public at ridiculous valuation IPOs that were double 2x3x. I think what’s happened now, it’s interesting is you had so much access in the public markets, and we forgotten very quickly in 2021. 2021, you had I think the number is 1,100 IPOs, off which, 600 were SPACs. Remember those? Many of those just blew up. Some of those were like we work, which went to zero, others, 23 and me, for example. All these sacks went public at 10 bucks, but 23 and M is trading at pennies. Again, look at previous cycles, 2000, for example. It takes the IPO market at a minimum of four years to recover, and you haven’t had excess in the public markets. Yes, NVIDIA has been a rocket ship, but if you look at NVIDIA, it creates that depending on what your projection is between 35-40 times earnings. That’s not for a company with 75% profit margins and growing the way it has. That’s not outrageous. Outrageous was Cisco at 200 times earnings in year 2000. by the way, if you’d invested in Cisco in the year 2000, you’d still be losing. It’s the private markets that’s why there’s a lot of raised eyebrows.

Ricky Mulvey: Think why is there so much laggy you think in the private markets compared to the public markets right now, especially with Froth? You mentioned the spack lesson, where I got burned a little bit on a couple of SPACs that I got excited about that still haven’t recovered. But within the private markets especially, it seems to be ruled by almost the lesson that you mentioned earlier with Masa Son not investing in Facebook at $10 million. A lot of these private market investors, VCs, almost don’t lament the things they spent money on and then lost. They lament the opportunities that passed them by that ended up 100 X, 1,000 Xing, that thing.

Alok Sama: Look, these are some of the smartest, savviest people around, and that put Masa Keno Hill in terms of his ability to spot macro trends, and there’s no doubt that what’s going on with AI certainly at the enterprise level, where it’s proving out very quickly, truly is transformational as a productivity true. I think the jury is out in terms of at the individual level, how it might impact our lives. I haven’t seen any apps, the way we did with Web 2.0. Uber, etc. Maybe those will come, but the jury is still out. But at the enterprise level, it is transformational as a productivity true, and people get that, and there’s just not a lot of plays around. As a VC, it’s not a trend you can sit on out. It out. You’re seeing that. There are others, for example, I’m associated with Warburg Pincuse, which is not a household name, but one for people in the business would recognize it as absolutely cutting edge when it comes to growth investing, particularly in technology. They’ve chosen to set out these big flashy evaluations, and I focus instead on AI, the enterprise level and buying it to businesses where you could make a huge impact on margins, can top line, as well as bottom line, leveraging AI. it is I’m being up if I’m answering your question, but from a VC growth investive perspective, it’s like, you can’t afford to sit this out.

Ricky Mulvey: It’s something where with your analytical brain, you can’t value. If we’re moving toward the singularity.

Ricky Mulvey: How do you even put a price tag on that thing? Let’s get in.

Alok Sama: I do put a price tag on dreams a little bit. I may I use that expression in my book. It’s tough. The excitement is very real. I’m excited about it. I just can’t figure out or value it.

Ricky Mulvey: Let’s get into your journey at SoftBank. The investing style really revolves around the happiness for everyone pitch, this dream of Masa Son. While I know you’ve heard it a bunch of times, many of our listeners haven’t. What is happiness for everyone?

Alok Sama: What he’s trying to get at is idealism when it comes to technology investing. Let’s go back. General Electric used to be a technology company once upon a time. It’s Thomas Edison’s Company. You could make a legitimate case that electricity, light bubs, for example, contributed to helps for everyone. I think that’s a lot of what Son Sann’s talking about, which is leveraging technology to improve lives. Happiness, he can get overly philosophical about that, but that’s what he’s trying to get at. The first time I met him, I remember right in the lobby of his building, and then he talked about it when I met with him. He had this empathetic robot, Pepper, which was supposed to be a companion for the agent. This is again, AI powered with an emotional engine, supposed to be a companion in Japan, with an aging population. It’s a real issue with the highest suicide rates in the world. That’s addressing, that’s laudable. That’s a lot of where Masa is coming from. Very different from history of AI is a benign. It’s going to make lives better view, different from Elon who thinks that this might be something we have to run away from and colonize mass.

Ricky Mulvey: There’s also I was talking to Nate Silver on the show a few weeks ago. It’s the AI makes the world a worse version of a casino. You mentioned to the robot, and many of the predictions of Masa son came true. With the Pepper robot, you now have AI chat bots that are exactly like the movie Her, where people are having quote, real relationships with them in order to combat loneliness. That’s a whole rabbit hole, we have very complicated feelings. But for the base of this, it’s something that it came true. When you were going through these deals, was that something where, you would present a evaluation case, but you would also have to present this is how it makes the world happier with the companies we’re interested in investing in or did that come upstream before it got to you?

Alok Sama: Short answer is no. We didn’t have, I never thought about it, but, something like a happiness index or anything associated with an investment memo. But the thing about Masa, and this is what really got me hooked. This is a man who describes himself as a crazy guy who lives in the future. A lot of people think of investing as bits. Almost gambling. Son is not a man, you’ll find within a million mile radius of Vegas. She’s not a gambling man. I associate gambling with addictive thrill seeking behavior. That’s not him. A man who lives in the future and when you live in the future, you say tomorrow’s headlines, your assessment of risk is fundamentally different. It was often felt when I had doubts, reservations, who am I to hold him back? He backed Alibaba. Based on his vision for what e-commerce might unfold in China, based on looking at how it had evolved in the US. But I tell you, what’s even cooler? This is literally my favorite Masa Son story, and I think one that people will relate to.

I think we can all agree. We all felt that excitement when we held a smartphone and iPhone for the first time, I certainly did in my hands, which is, man, this is seriously cool. This is life changing. Now, but Masa Son, before the iPhone existed, as is talking about 2005, draws up a picture of something that looks like an iPhone and takes it to Steve Jobs and said, Steve, you’re the only one who can come up with something like this and when you do, you got to give me an exclusive for Japan. Steve tells him, you’re a crazy guy. I like you. I don’t have a product. You don’t have a phone company. What am I going to give you an exclusive for, but I like you. If I do something like this, I’ll give you an exclusive. On the back of this somewhat casual conversation, handshake, no contractual obligation. He goes and spends $20 billion buying or close to 20 billion buying this company in Japan, which is just bleeding cash. It is such a dog that Vodafone, which owned the company actually lends Masa money to take it off its hands. Steve Jobs comes up with the iPhone in early 2007, and gives Masa the exclusive, because he always saw this smartphones, he builds this company around marketing data oriented network, selling smartphones to the Japanese, and ends up on a mark to market basis when the company went public, making $40 billion. It’s a monumental number. Hundred billion mark to market on Arm, 75 billion on Alibaba, 40 billion on SoftBank, Japan, the mobile company. These are spectacular successes.

Ricky Mulvey: When you meet him through your friend, it was Nikesh. Where you met Masa Son and you said, I made Masa feel I understood his brand of genius. I’ll quote.” As a banker you have to make a lot of really wealthy people feel smart and understood”. This is that game at the highest level. How do you do that?

Alok Sama: I talk a little bit about that. I think my experience with CEOs is they like to talk about their business, their vision, and they don’t like being sold to. When you start reading from a pitch book, and you get into salesy mode, you denigrate yourself a little bit. My approach was always to look them in the eye, and as if I’m having a cup of coffee with them, having a drink with them, and let them talk and hopefully try and respond intelligently to what they say. You get up rapper going, and they come away saying that, OK, this is a guy I can relate to. He gets me, and when they have an idea or a problem they want to solve, hopefully they call you.

Ricky Mulvey: With Masa, you don’t need to convince him that, you’re also a crazy guy. Like he’s not looking for that? He’s not looking for a little bit of crazy.

Alok Sama: Well, look. One of the pivotal chapters in the book is I talked about this idea of hunters and cooks. Son Sann tells me that, you need to be more of a hunter. You’re basically suggesting I was a cook. Sorry, Wait.

Ricky Mulvey: You’re Michelin Cook.

Alok Sama: Well, that was a Michelin star chef man. That’s what I was fishing for, because I was good at what I did, which is getting deals done. No, but honestly, my role there, and I think that’s true for a lot of people around Son Sann is they tend to be facilitators facilitating his vision because the quality he has, living in the future, vision, as a futurist as a technologist, is just not something you can replicate. I did not have that. That is part of why people often ask me, you’re cynical about Silicon Valley, you’re cynical about Wall Street, which you seem to put Masa Son on a pedestal. That’s the reason. He had this quality that completely eludes me. When he tells me that you’re not enough of a hunter. I get where he’s coming from. I don’t see what he does. I don’t see risk the way he sees it.

Ricky Mulvey: One of the central themes of your book is the idea of power, and how there are people who you have an immense amount of power you’re flying on private jets. You’re moving in billions of dollars. Then there’s also times within your interactions with Masa Son, where you appear almost, like, more powerless. I would say one of those is within the WeWork deal where Softbank goes on to invest tens of billions of dollars in WeWork. You seem to be in the spot where you’re like, this person is a silver tongued Adam Neumann, like a silver-tongued snake oil salesperson. Feel free to disagree with my assessment. I see a shake of the head.

Alok Sama: Wow, two things. I talk about power, but not to be overly philosophical about this, but I talk about power being an illusion. In the epilogue, book starts with a dramatic scene where I’m at Claridges Hotel in Mayfair in London with two most agents, if you can believe. They tell me I have power because I control billiger dollars, and my feedback to them is power. That’s an illusion. I can barely control my own bladder. It gets philosophical when I lose both my parents, my dog within a very short period of time. It just brings home that the notion that you control anything in your life is a bit of an illusion. That’s a bit of a philosophical as opposed to an investment point. In the context of WeWork, look, it’s Adam Neumann it’s a cool fun story. He’s been a movie made about it. It’s a fun movie. I enjoyed it. Jared Leto does a great job. Son, he acknowledged it himself. I think his exact words were. He said that I blame myself even more than Adam Neumann. That’s the nature of the VC game. You’re not gonna get everything. You just got to keep in mind that he might have lost $10 billion on WeWork, which is monumental by any standards, but he also made 100 billion on Arm. I take that trade any day.

Ricky Mulvey: Well, I’m going to stand on the philosophical point for a sec, because I think it’s interesting where you put that. There’s multiple definitions of power, and we almost need different words for it. There’s the idea that you cannot control almost the acts of uncontrollable natural forces, sickness, that thing. We have that word for power, but then we also have the ability to make people do things. That is also combined by power and when billions of dollars is being put into WeWork, when billions of dollars is being put into chip companies, there’s a business model that you’re also a part of that has led to things like people getting free Uber rides. That I’ve been on the downstream of SoftBanks actions in the market. That is an intense form of power, man. That’s also very real. It’s different from the other thing you’re describing.

Alok Sama: Look, that’s fair. I think the impact that SoftBank had on the investment landscape in the Valley is profound. I talk the book about how Sequoia, which is King of the Hill in the Valley. That’s Google, you name it. Every major technology success story they’ve been behind. I’m a bit of a golf nut and I described the meeting with Doug Leone, who’s the managing partner, Sequoia. His reaction using a golfing metaphor. I go back to Bobby Jones, arguably the greatest of all times when he sees Jack Nicklaus play and his reaction is, he plays a game with which I’m not familiar. What Masa did with the vision Fund did was a game changer and just to be very specific, Sequoia, billion dollar funds were rare in the value. Sequoia was probably the biggest one. I think that fund was two billion. The next fund turned out to be eight billion.

Everyone felt they needed a bigger boat. That when that $100 billion fund came along. I think the total volume of VC investing in the previous year was 70 billion. This was monumental. We talked about OpenAI toward the beginning of that discussion. It’s these large mega-cap technology funds, venture slash growth funds, with a ton of liquidity and that’s a little bit of what you’re saying. They need to deploy a lot of money in the new thing. You still saying that. A little bit of that is the SoftBank effect. A little bit of that is also this weird notion we had of modern monetary theory and printing money. It’s a combination of factors.

Ricky Mulvey: Sequoia, the relationship with them wasn’t always rosy. They were upset at SoftBank because of essentially the valuations and the money that the investment fund was putting in to smaller companies to which they were also invested, which on the surface, you would think, great, more money going into an investment I own, the valuations getting larger. I’m making a lot of money off of this, but that wasn’t the case always with Sequoia.

Alok Sama: No. I think their objection to be fair was, again, it comes back to the notion of power and control. The conventional VC approach is you sit on the board and you drift feed capital. Like you’re talking about tens of millions at the time, I gave you a certain benchmarks, I evaluate you against that, you hit your goals, I’ll give you no money, so on so forth. I very tightly controlled allocation capital. Nothing wrong with that. It serve people like Sequoia brilliantly. Masa’s view is, I used the expression.

He treated founders, the way they want to be treated by an investor, which is I love you, man. It is I give the example of Radesh, which is what came up in the context of Sequoia. Radesh got married, Masa flew from Japan to India to attend the guys’ marriage. It’s that personal level of engagement that belief in an entrepreneur. I believe in you, I back you, whatever capital you need. I’m behind you. I think that’s a little bit of what the VCs were struggling with. That’s one of the things that’s very different about how Masa approach to investing.

Ricky Mulvey: One of the things you write about, let’s talk about selling. This is something a lot of our listeners think about, especially, we’re heavy into a mega trend. We’re back into a bull market. You right, “While Masa had an impressive track record investing ahead of technology mega trends, he frequently held on to long.” We’ll start with what led you to that conclusion, and then I’ll ask you what you learned from it. Why do you think Masa held on too long? Because frequently we hear the reverse that investors are too tradery, and they sell too much, and that hurts them.

Alok Sama: I think let’s look at that comment was made at probably halfway through the book and just based on the observation, that South Banks Yahoo stake, Yahoo was king of the hell. Some of us who we are old enough to remember, like late ’90s, 2000, it was the portal to the web. His stake in Yahoo at its peak was 30 billion. He ended up selling it at seven billion. I think the same thing turned out to be true with Alibaba. I think on a mark to market basis at one point, Masa that stake would have been worth, I want to say 200 billion or something very close to that. At its peak, he ended up liquidating it at 75 billion. Now, it is still a spectacular success story, or those are still spectacular success stories. But obviously, had he sold off at a different time, he would have made a lot more, which would suggest that, he’s not a great trader, but man that’s a completely different skill set. That’s what prompted that remark.

Ricky Mulvey: The other side of this though is Nvidia. When SoftBank didn’t have an investment, and, it’s better to have loved than who have never loved at all. But what led to the sale in Nvidia? Because this is what happened to the fact.

Alok Sama: That’s a great question. I think we can learn something from that. First of all, two things about Nvidia. Early 2017, Masa wanted to buy the company Nvidia. With a controlled premium, we could have bought the company for $80 billion. Could have been a history, it’s worth over two trillion now. We all know that. CFIs, which is the Committee for Foreign Investment to the United States, there is no way, the US government would have CFIs. Acting through CFIs would have allowed a deal like that, foreign ownership of something as strategic to AIs and Nvidia, so that was off the table. What Masa ended up doing is buying in the fund. When you buy on your own balance sheet, if you’ve actually bought a company, the way he did on, with the intention of holding on, making some operational changes, as opposed to buying on a leverage basis in a fund with this pressure to recycle fund to investors, your mindset changes a little bit, and that’s what happened with Nvidia in the fund, which is, he on a leverage basis, made a brilliant return. But if he’d held on, that that 4x, 5x could have been 20x.

Ricky Mulvey: Some of that, did that have to do with the funds deal where it was paying out, what was it like a 7% dividend to all of its holders through out which is uncommon for a tech when we think of high tech investments, you’re going for those big home runs. You’re not going for these steady dividend payments.

Alok Sama: The division fund was completely unique, in as much as there was a layer of leverage provided by the limited partners. That was part of the fund. The investors, the limited partners, mainly the Middle Eastern investors out of Saudi Arabia and the United Arab Emirates, they also provided capital in the form of mezzanine, which paid a cash dividend 7%. The fund had to pay them cash, and that created pressure to realize liquidity and that again, is at least a small part of the explanation, that when you have an opportunity to liquidate something, you try and do it.

Ricky Mulvey: You told the story earlier of the dinner you had where you were described as a cook and not a hunter. Your job changed dramatically at SoftBank, around 2019. You went from president and CFO to senior advisor. When did you feel your job really changing? That we talked about power as a nebulous thing. When did you feel your power softening and feeling almost sideline moved out of one of the top seats there?

Alok Sama: I think that happened earlier. When I left and became a senior advisor, I was basically out. That’s the way I wanted it, and that’s the way we negotiated. Someone wanted me out of the vision fund. When I was shut out of the vision fund, even though there was some very interesting stuff that was going on outside of the vision fund, for example, SoftBank owned Sprint and I let the merger of Sprint with T mobile. There was a lot to do outside of the vision fund, but I was excluded from the vision fund, and at the time, SoftBank focus was very much on the vision fund. That was an element, I think it’s fair to say of being if not sideline, certainly being one step removed from where the real action was. That’s where it started to happen in terms of the drift.

Ricky Mulvey: Did a two part question, then I went down a digression, I’m going to get back to the two part question now that I remember it. What did you learn about when to sell from your experience at SoftBank? How does that affect you as an investor now?

Alok Sama: My personal philosophy is, that whole line about, bulls make money, bears make money, pigs get slaughtered. My personal view of the world is, man, if I run into a situation where I’ve doubled my money or tripled my money or whatever, I’m out of there. I tend not to get too greedy. But that’s not in the world of technology, that is most certainly not the right answer. Because if you’ve got a winner in the world of technology, you need to be thinking, not just 10x, but, like, potentially a 100x. Like Masa Son, you look at the Alibaba success story, that’s like, 40 million, eventually, 75 billion realized. Now, it would be really unfair to criticize him for not realizing 200 billion because it is arguably the most spectacular investment all time. My mindset is a little bit conservative because, I’m particularly at my stage in life. I’m thinking in terms of my nest egg for retirement. But if you want to be a successful technology investor, you’ve got to think in terms of really backing your winners. You’re seeing that with the funds. Sequoia started this is frequently because of the venture funds. Because of pressure to recycle capital, they were getting out too early, they created a separate fund where you could hang on much much longer. It’s like, Google computer next google. You bought Google at IPO, it’d be a spectacular investment.

Ricky Mulvey: The money trap lost illusions inside the tech bubble. I want to mention this to listeners. You didn’t get a ghost writer for this. It is beautifully, right?

Alok Sama: What? No. Quite the contrary, I did not set off to write this book, but I wanted to be a writer, and I spent two-and-a-half years in graduate school. I got an MFA at New York University. Just in experimenting, like all students do, was like, I was writing and throwing stuff up on the wall and see what’s Dick’s thing. That’s how this book came about. It’s been a real labor of love for me.

Ricky Mulvey: It’s a lyrical, it’s beautifully written. I really enjoyed the stories in it. I learned some stuff for my investing brain. I think our listeners will get a lot out of it. There’s a lot of big business people when they write a memoir, sometimes it’s a history written things that’s given off to a ghost writer. Your book is the complete opposite of that. It’s thoughtful, it’s warm, it’s personal. I really enjoyed it, and I’m grateful for the time and insight.

Alok Sama: Thanks, Wicky.

Mary Long: As always, people on the program may have interest in the stocks they talk about, and the Motley Fool may have formal recommendations for or against, so don’t buy yourself stocks based solely on what you hear. I’m Mary Long. Thanks for listening. We’ll see on Monday Fools.

You may like

Noticias

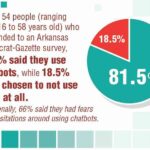

Revivir el compromiso en el aula de español: un desafío musical con chatgpt – enfoque de la facultad

Published

8 meses agoon

6 junio, 2025

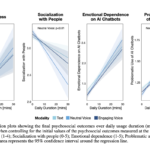

A mitad del semestre, no es raro notar un cambio en los niveles de energía de sus alumnos (Baghurst y Kelley, 2013; Kumari et al., 2021). El entusiasmo inicial por aprender un idioma extranjero puede disminuir a medida que otros cursos con tareas exigentes compitan por su atención. Algunos estudiantes priorizan las materias que perciben como más directamente vinculadas a su especialidad o carrera, mientras que otros simplemente sienten el peso del agotamiento de mediados de semestre. En la primavera, los largos meses de invierno pueden aumentar esta fatiga, lo que hace que sea aún más difícil mantener a los estudiantes comprometidos (Rohan y Sigmon, 2000).

Este es el momento en que un instructor de idiomas debe pivotar, cambiando la dinámica del aula para reavivar la curiosidad y la motivación. Aunque los instructores se esfuerzan por incorporar actividades que se adapten a los cinco estilos de aprendizaje preferidos (Felder y Henriques, 1995)-Visual (aprendizaje a través de imágenes y comprensión espacial), auditivo (aprendizaje a través de la escucha y discusión), lectura/escritura (aprendizaje a través de interacción basada en texto), Kinesthetic (aprendizaje a través de movimiento y actividades prácticas) y multimodal (una combinación de múltiples estilos)-its is beneficiales). Estructurado y, después de un tiempo, clases predecibles con actividades que rompen el molde. La introducción de algo inesperado y diferente de la dinámica del aula establecida puede revitalizar a los estudiantes, fomentar la creatividad y mejorar su entusiasmo por el aprendizaje.

La música, en particular, ha sido durante mucho tiempo un aliado de instructores que enseñan un segundo idioma (L2), un idioma aprendido después de la lengua nativa, especialmente desde que el campo hizo la transición hacia un enfoque más comunicativo. Arraigado en la interacción y la aplicación del mundo real, el enfoque comunicativo prioriza el compromiso significativo sobre la memorización de memoria, ayudando a los estudiantes a desarrollar fluidez de formas naturales e inmersivas. La investigación ha destacado constantemente los beneficios de la música en la adquisición de L2, desde mejorar la pronunciación y las habilidades de escucha hasta mejorar la retención de vocabulario y la comprensión cultural (DeGrave, 2019; Kumar et al. 2022; Nuessel y Marshall, 2008; Vidal y Nordgren, 2024).

Sobre la base de esta tradición, la actividad que compartiremos aquí no solo incorpora música sino que también integra inteligencia artificial, agregando una nueva capa de compromiso y pensamiento crítico. Al usar la IA como herramienta en el proceso de aprendizaje, los estudiantes no solo se familiarizan con sus capacidades, sino que también desarrollan la capacidad de evaluar críticamente el contenido que genera. Este enfoque los alienta a reflexionar sobre el lenguaje, el significado y la interpretación mientras participan en el análisis de texto, la escritura creativa, la oratoria y la gamificación, todo dentro de un marco interactivo y culturalmente rico.

Descripción de la actividad: Desafío musical con Chatgpt: “Canta y descubre”

Objetivo:

Los estudiantes mejorarán su comprensión auditiva y su producción escrita en español analizando y recreando letras de canciones con la ayuda de ChatGPT. Si bien las instrucciones se presentan aquí en inglés, la actividad debe realizarse en el idioma de destino, ya sea que se enseñe el español u otro idioma.

Instrucciones:

1. Escuche y decodifique

- Divida la clase en grupos de 2-3 estudiantes.

- Elija una canción en español (por ejemplo, La Llorona por chavela vargas, Oye CÓMO VA por Tito Puente, Vivir mi Vida por Marc Anthony).

- Proporcione a cada grupo una versión incompleta de la letra con palabras faltantes.

- Los estudiantes escuchan la canción y completan los espacios en blanco.

2. Interpretar y discutir

- Dentro de sus grupos, los estudiantes analizan el significado de la canción.

- Discuten lo que creen que transmiten las letras, incluidas las emociones, los temas y cualquier referencia cultural que reconocan.

- Cada grupo comparte su interpretación con la clase.

- ¿Qué crees que la canción está tratando de comunicarse?

- ¿Qué emociones o sentimientos evocan las letras para ti?

- ¿Puedes identificar alguna referencia cultural en la canción? ¿Cómo dan forma a su significado?

- ¿Cómo influye la música (melodía, ritmo, etc.) en su interpretación de la letra?

- Cada grupo comparte su interpretación con la clase.

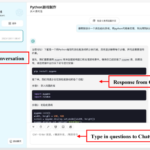

3. Comparar con chatgpt

- Después de formar su propio análisis, los estudiantes preguntan a Chatgpt:

- ¿Qué crees que la canción está tratando de comunicarse?

- ¿Qué emociones o sentimientos evocan las letras para ti?

- Comparan la interpretación de ChatGPT con sus propias ideas y discuten similitudes o diferencias.

4. Crea tu propio verso

- Cada grupo escribe un nuevo verso que coincide con el estilo y el ritmo de la canción.

- Pueden pedirle ayuda a ChatGPT: “Ayúdanos a escribir un nuevo verso para esta canción con el mismo estilo”.

5. Realizar y cantar

- Cada grupo presenta su nuevo verso a la clase.

- Si se sienten cómodos, pueden cantarlo usando la melodía original.

- Es beneficioso que el profesor tenga una versión de karaoke (instrumental) de la canción disponible para que las letras de los estudiantes se puedan escuchar claramente.

- Mostrar las nuevas letras en un monitor o proyector permite que otros estudiantes sigan y canten juntos, mejorando la experiencia colectiva.

6. Elección – El Grammy va a

Los estudiantes votan por diferentes categorías, incluyendo:

- Mejor adaptación

- Mejor reflexión

- Mejor rendimiento

- Mejor actitud

- Mejor colaboración

7. Reflexión final

- ¿Cuál fue la parte más desafiante de comprender la letra?

- ¿Cómo ayudó ChatGPT a interpretar la canción?

- ¿Qué nuevas palabras o expresiones aprendiste?

Pensamientos finales: música, IA y pensamiento crítico

Un desafío musical con Chatgpt: “Canta y descubre” (Desafío Musical Con Chatgpt: “Cantar y Descubrir”) es una actividad que he encontrado que es especialmente efectiva en mis cursos intermedios y avanzados. Lo uso cuando los estudiantes se sienten abrumados o distraídos, a menudo alrededor de los exámenes parciales, como una forma de ayudarlos a relajarse y reconectarse con el material. Sirve como un descanso refrescante, lo que permite a los estudiantes alejarse del estrés de las tareas y reenfocarse de una manera divertida e interactiva. Al incorporar música, creatividad y tecnología, mantenemos a los estudiantes presentes en la clase, incluso cuando todo lo demás parece exigir su atención.

Más allá de ofrecer una pausa bien merecida, esta actividad provoca discusiones atractivas sobre la interpretación del lenguaje, el contexto cultural y el papel de la IA en la educación. A medida que los estudiantes comparan sus propias interpretaciones de las letras de las canciones con las generadas por ChatGPT, comienzan a reconocer tanto el valor como las limitaciones de la IA. Estas ideas fomentan el pensamiento crítico, ayudándoles a desarrollar un enfoque más maduro de la tecnología y su impacto en su aprendizaje.

Agregar el elemento de karaoke mejora aún más la experiencia, dando a los estudiantes la oportunidad de realizar sus nuevos versos y divertirse mientras practica sus habilidades lingüísticas. Mostrar la letra en una pantalla hace que la actividad sea más inclusiva, lo que permite a todos seguirlo. Para hacerlo aún más agradable, seleccionando canciones que resuenen con los gustos de los estudiantes, ya sea un clásico como La Llorona O un éxito contemporáneo de artistas como Bad Bunny, Selena, Daddy Yankee o Karol G, hace que la actividad se sienta más personal y atractiva.

Esta actividad no se limita solo al aula. Es una gran adición a los clubes españoles o eventos especiales, donde los estudiantes pueden unirse a un amor compartido por la música mientras practican sus habilidades lingüísticas. Después de todo, ¿quién no disfruta de una buena parodia de su canción favorita?

Mezclar el aprendizaje de idiomas con música y tecnología, Desafío Musical Con Chatgpt Crea un entorno dinámico e interactivo que revitaliza a los estudiantes y profundiza su conexión con el lenguaje y el papel evolutivo de la IA. Convierte los momentos de agotamiento en oportunidades de creatividad, exploración cultural y entusiasmo renovado por el aprendizaje.

Angela Rodríguez Mooney, PhD, es profesora asistente de español y la Universidad de Mujeres de Texas.

Referencias

Baghurst, Timothy y Betty C. Kelley. “Un examen del estrés en los estudiantes universitarios en el transcurso de un semestre”. Práctica de promoción de la salud 15, no. 3 (2014): 438-447.

DeGrave, Pauline. “Música en el aula de idiomas extranjeros: cómo y por qué”. Revista de Enseñanza e Investigación de Lenguas 10, no. 3 (2019): 412-420.

Felder, Richard M. y Eunice R. Henriques. “Estilos de aprendizaje y enseñanza en la educación extranjera y de segundo idioma”. Anales de idiomas extranjeros 28, no. 1 (1995): 21-31.

Nuessel, Frank y April D. Marshall. “Prácticas y principios para involucrar a los tres modos comunicativos en español a través de canciones y música”. Hispania (2008): 139-146.

Kumar, Tribhuwan, Shamim Akhter, Mehrunnisa M. Yunus y Atefeh Shamsy. “Uso de la música y las canciones como herramientas pedagógicas en la enseñanza del inglés como contextos de idiomas extranjeros”. Education Research International 2022, no. 1 (2022): 1-9

Noticias

5 indicaciones de chatgpt que pueden ayudar a los adolescentes a lanzar una startup

Published

8 meses agoon

5 junio, 2025

Teen emprendedor que usa chatgpt para ayudarlo con su negocio

El emprendimiento adolescente sigue en aumento. Según Junior Achievement Research, el 66% de los adolescentes estadounidenses de entre 13 y 17 años dicen que es probable que considere comenzar un negocio como adultos, con el monitor de emprendimiento global 2023-2024 que encuentra que el 24% de los jóvenes de 18 a 24 años son actualmente empresarios. Estos jóvenes fundadores no son solo soñando, están construyendo empresas reales que generan ingresos y crean un impacto social, y están utilizando las indicaciones de ChatGPT para ayudarlos.

En Wit (lo que sea necesario), la organización que fundó en 2009, hemos trabajado con más de 10,000 jóvenes empresarios. Durante el año pasado, he observado un cambio en cómo los adolescentes abordan la planificación comercial. Con nuestra orientación, están utilizando herramientas de IA como ChatGPT, no como atajos, sino como socios de pensamiento estratégico para aclarar ideas, probar conceptos y acelerar la ejecución.

Los emprendedores adolescentes más exitosos han descubierto indicaciones específicas que los ayudan a pasar de una idea a otra. Estas no son sesiones genéricas de lluvia de ideas: están utilizando preguntas específicas que abordan los desafíos únicos que enfrentan los jóvenes fundadores: recursos limitados, compromisos escolares y la necesidad de demostrar sus conceptos rápidamente.

Aquí hay cinco indicaciones de ChatGPT que ayudan constantemente a los emprendedores adolescentes a construir negocios que importan.

1. El problema del primer descubrimiento chatgpt aviso

“Me doy cuenta de que [specific group of people]

luchar contra [specific problem I’ve observed]. Ayúdame a entender mejor este problema explicando: 1) por qué existe este problema, 2) qué soluciones existen actualmente y por qué son insuficientes, 3) cuánto las personas podrían pagar para resolver esto, y 4) tres formas específicas en que podría probar si este es un problema real que vale la pena resolver “.

Un adolescente podría usar este aviso después de notar que los estudiantes en la escuela luchan por pagar el almuerzo. En lugar de asumir que entienden el alcance completo, podrían pedirle a ChatGPT que investigue la deuda del almuerzo escolar como un problema sistémico. Esta investigación puede llevarlos a crear un negocio basado en productos donde los ingresos ayuden a pagar la deuda del almuerzo, lo que combina ganancias con el propósito.

Los adolescentes notan problemas de manera diferente a los adultos porque experimentan frustraciones únicas, desde los desafíos de las organizaciones escolares hasta las redes sociales hasta las preocupaciones ambientales. Según la investigación de Square sobre empresarios de la Generación de la Generación Z, el 84% planea ser dueños de negocios dentro de cinco años, lo que los convierte en candidatos ideales para las empresas de resolución de problemas.

2. El aviso de chatgpt de chatgpt de chatgpt de realidad de la realidad del recurso

“Soy [age] años con aproximadamente [dollar amount] invertir y [number] Horas por semana disponibles entre la escuela y otros compromisos. Según estas limitaciones, ¿cuáles son tres modelos de negocio que podría lanzar de manera realista este verano? Para cada opción, incluya costos de inicio, requisitos de tiempo y los primeros tres pasos para comenzar “.

Este aviso se dirige al elefante en la sala: la mayoría de los empresarios adolescentes tienen dinero y tiempo limitados. Cuando un empresario de 16 años emplea este enfoque para evaluar un concepto de negocio de tarjetas de felicitación, puede descubrir que pueden comenzar con $ 200 y escalar gradualmente. Al ser realistas sobre las limitaciones por adelantado, evitan el exceso de compromiso y pueden construir hacia objetivos de ingresos sostenibles.

Según el informe de Gen Z de Square, el 45% de los jóvenes empresarios usan sus ahorros para iniciar negocios, con el 80% de lanzamiento en línea o con un componente móvil. Estos datos respaldan la efectividad de la planificación basada en restricciones: cuando funcionan los adolescentes dentro de las limitaciones realistas, crean modelos comerciales más sostenibles.

3. El aviso de chatgpt del simulador de voz del cliente

“Actúa como un [specific demographic] Y dame comentarios honestos sobre esta idea de negocio: [describe your concept]. ¿Qué te excitaría de esto? ¿Qué preocupaciones tendrías? ¿Cuánto pagarías de manera realista? ¿Qué necesitaría cambiar para que se convierta en un cliente? “

Los empresarios adolescentes a menudo luchan con la investigación de los clientes porque no pueden encuestar fácilmente a grandes grupos o contratar firmas de investigación de mercado. Este aviso ayuda a simular los comentarios de los clientes haciendo que ChatGPT adopte personas específicas.

Un adolescente que desarrolla un podcast para atletas adolescentes podría usar este enfoque pidiéndole a ChatGPT que responda a diferentes tipos de atletas adolescentes. Esto ayuda a identificar temas de contenido que resuenan y mensajes que se sienten auténticos para el público objetivo.

El aviso funciona mejor cuando se vuelve específico sobre la demografía, los puntos débiles y los contextos. “Actúa como un estudiante de último año de secundaria que solicita a la universidad” produce mejores ideas que “actuar como un adolescente”.

4. El mensaje mínimo de diseñador de prueba viable chatgpt

“Quiero probar esta idea de negocio: [describe concept] sin gastar más de [budget amount] o más de [time commitment]. Diseñe tres experimentos simples que podría ejecutar esta semana para validar la demanda de los clientes. Para cada prueba, explique lo que aprendería, cómo medir el éxito y qué resultados indicarían que debería avanzar “.

Este aviso ayuda a los adolescentes a adoptar la metodología Lean Startup sin perderse en la jerga comercial. El enfoque en “This Week” crea urgencia y evita la planificación interminable sin acción.

Un adolescente que desea probar un concepto de línea de ropa podría usar este indicador para diseñar experimentos de validación simples, como publicar maquetas de diseño en las redes sociales para evaluar el interés, crear un formulario de Google para recolectar pedidos anticipados y pedirles a los amigos que compartan el concepto con sus redes. Estas pruebas no cuestan nada más que proporcionar datos cruciales sobre la demanda y los precios.

5. El aviso de chatgpt del generador de claridad de tono

“Convierta esta idea de negocio en una clara explicación de 60 segundos: [describe your business]. La explicación debe incluir: el problema que resuelve, su solución, a quién ayuda, por qué lo elegirían sobre las alternativas y cómo se ve el éxito. Escríbelo en lenguaje de conversación que un adolescente realmente usaría “.

La comunicación clara separa a los empresarios exitosos de aquellos con buenas ideas pero una ejecución deficiente. Este aviso ayuda a los adolescentes a destilar conceptos complejos a explicaciones convincentes que pueden usar en todas partes, desde las publicaciones en las redes sociales hasta las conversaciones con posibles mentores.

El énfasis en el “lenguaje de conversación que un adolescente realmente usaría” es importante. Muchas plantillas de lanzamiento comercial suenan artificiales cuando se entregan jóvenes fundadores. La autenticidad es más importante que la jerga corporativa.

Más allá de las indicaciones de chatgpt: estrategia de implementación

La diferencia entre los adolescentes que usan estas indicaciones de manera efectiva y aquellos que no se reducen a seguir. ChatGPT proporciona dirección, pero la acción crea resultados.

Los jóvenes empresarios más exitosos con los que trabajo usan estas indicaciones como puntos de partida, no de punto final. Toman las sugerencias generadas por IA e inmediatamente las prueban en el mundo real. Llaman a clientes potenciales, crean prototipos simples e iteran en función de los comentarios reales.

Investigaciones recientes de Junior Achievement muestran que el 69% de los adolescentes tienen ideas de negocios, pero se sienten inciertos sobre el proceso de partida, con el miedo a que el fracaso sea la principal preocupación para el 67% de los posibles empresarios adolescentes. Estas indicaciones abordan esa incertidumbre al desactivar los conceptos abstractos en los próximos pasos concretos.

La imagen más grande

Los emprendedores adolescentes que utilizan herramientas de IA como ChatGPT representan un cambio en cómo está ocurriendo la educación empresarial. Según la investigación mundial de monitores empresariales, los jóvenes empresarios tienen 1,6 veces más probabilidades que los adultos de querer comenzar un negocio, y son particularmente activos en la tecnología, la alimentación y las bebidas, la moda y los sectores de entretenimiento. En lugar de esperar clases de emprendimiento formales o programas de MBA, estos jóvenes fundadores están accediendo a herramientas de pensamiento estratégico de inmediato.

Esta tendencia se alinea con cambios más amplios en la educación y la fuerza laboral. El Foro Económico Mundial identifica la creatividad, el pensamiento crítico y la resiliencia como las principales habilidades para 2025, la capacidad de las capacidades que el espíritu empresarial desarrolla naturalmente.

Programas como WIT brindan soporte estructurado para este viaje, pero las herramientas en sí mismas se están volviendo cada vez más accesibles. Un adolescente con acceso a Internet ahora puede acceder a recursos de planificación empresarial que anteriormente estaban disponibles solo para empresarios establecidos con presupuestos significativos.

La clave es usar estas herramientas cuidadosamente. ChatGPT puede acelerar el pensamiento y proporcionar marcos, pero no puede reemplazar el arduo trabajo de construir relaciones, crear productos y servir a los clientes. La mejor idea de negocio no es la más original, es la que resuelve un problema real para personas reales. Las herramientas de IA pueden ayudar a identificar esas oportunidades, pero solo la acción puede convertirlos en empresas que importan.

Noticias

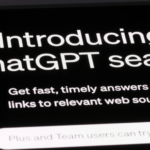

Chatgpt vs. gemini: he probado ambos, y uno definitivamente es mejor

Published

8 meses agoon

5 junio, 2025

Precio

ChatGPT y Gemini tienen versiones gratuitas que limitan su acceso a características y modelos. Los planes premium para ambos también comienzan en alrededor de $ 20 por mes. Las características de chatbot, como investigaciones profundas, generación de imágenes y videos, búsqueda web y más, son similares en ChatGPT y Gemini. Sin embargo, los planes de Gemini pagados también incluyen el almacenamiento en la nube de Google Drive (a partir de 2TB) y un conjunto robusto de integraciones en las aplicaciones de Google Workspace.

Los niveles de más alta gama de ChatGPT y Gemini desbloquean el aumento de los límites de uso y algunas características únicas, pero el costo mensual prohibitivo de estos planes (como $ 200 para Chatgpt Pro o $ 250 para Gemini Ai Ultra) los pone fuera del alcance de la mayoría de las personas. Las características específicas del plan Pro de ChatGPT, como el modo O1 Pro que aprovecha el poder de cálculo adicional para preguntas particularmente complicadas, no son especialmente relevantes para el consumidor promedio, por lo que no sentirá que se está perdiendo. Sin embargo, es probable que desee las características que son exclusivas del plan Ai Ultra de Gemini, como la generación de videos VEO 3.

Ganador: Géminis

Plataformas

Puede acceder a ChatGPT y Gemini en la web o a través de aplicaciones móviles (Android e iOS). ChatGPT también tiene aplicaciones de escritorio (macOS y Windows) y una extensión oficial para Google Chrome. Gemini no tiene aplicaciones de escritorio dedicadas o una extensión de Chrome, aunque se integra directamente con el navegador.

(Crédito: OpenAI/PCMAG)

Chatgpt está disponible en otros lugares, Como a través de Siri. Como se mencionó, puede acceder a Gemini en las aplicaciones de Google, como el calendario, Documento, ConducirGmail, Mapas, Mantener, FotosSábanas, y Música de YouTube. Tanto los modelos de Chatgpt como Gemini también aparecen en sitios como la perplejidad. Sin embargo, obtiene la mayor cantidad de funciones de estos chatbots en sus aplicaciones y portales web dedicados.

Las interfaces de ambos chatbots son en gran medida consistentes en todas las plataformas. Son fáciles de usar y no lo abruman con opciones y alternar. ChatGPT tiene algunas configuraciones más para jugar, como la capacidad de ajustar su personalidad, mientras que la profunda interfaz de investigación de Gemini hace un mejor uso de los bienes inmuebles de pantalla.

Ganador: empate

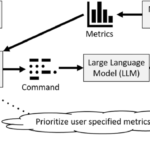

Modelos de IA

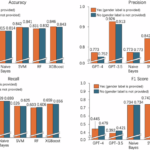

ChatGPT tiene dos series primarias de modelos, la serie 4 (su línea de conversación, insignia) y la Serie O (su compleja línea de razonamiento). Gemini ofrece de manera similar una serie Flash de uso general y una serie Pro para tareas más complicadas.

Los últimos modelos de Chatgpt son O3 y O4-Mini, y los últimos de Gemini son 2.5 Flash y 2.5 Pro. Fuera de la codificación o la resolución de una ecuación, pasará la mayor parte de su tiempo usando los modelos de la serie 4-Series y Flash. A continuación, puede ver cómo funcionan estos modelos en una variedad de tareas. Qué modelo es mejor depende realmente de lo que quieras hacer.

Ganador: empate

Búsqueda web

ChatGPT y Gemini pueden buscar información actualizada en la web con facilidad. Sin embargo, ChatGPT presenta mosaicos de artículos en la parte inferior de sus respuestas para una lectura adicional, tiene un excelente abastecimiento que facilita la vinculación de reclamos con evidencia, incluye imágenes en las respuestas cuando es relevante y, a menudo, proporciona más detalles en respuesta. Gemini no muestra nombres de fuente y títulos de artículos completos, e incluye mosaicos e imágenes de artículos solo cuando usa el modo AI de Google. El abastecimiento en este modo es aún menos robusto; Google relega las fuentes a los caretes que se pueden hacer clic que no resaltan las partes relevantes de su respuesta.

Como parte de sus experiencias de búsqueda en la web, ChatGPT y Gemini pueden ayudarlo a comprar. Si solicita consejos de compra, ambos presentan mosaicos haciendo clic en enlaces a los minoristas. Sin embargo, Gemini generalmente sugiere mejores productos y tiene una característica única en la que puede cargar una imagen tuya para probar digitalmente la ropa antes de comprar.

Ganador: chatgpt

Investigación profunda

ChatGPT y Gemini pueden generar informes que tienen docenas de páginas e incluyen más de 50 fuentes sobre cualquier tema. La mayor diferencia entre los dos se reduce al abastecimiento. Gemini a menudo cita más fuentes que CHATGPT, pero maneja el abastecimiento en informes de investigación profunda de la misma manera que lo hace en la búsqueda en modo AI, lo que significa caretas que se puede hacer clic sin destacados en el texto. Debido a que es más difícil conectar las afirmaciones en los informes de Géminis a fuentes reales, es más difícil creerles. El abastecimiento claro de ChatGPT con destacados en el texto es más fácil de confiar. Sin embargo, Gemini tiene algunas características de calidad de vida en ChatGPT, como la capacidad de exportar informes formateados correctamente a Google Docs con un solo clic. Su tono también es diferente. Los informes de ChatGPT se leen como publicaciones de foro elaboradas, mientras que los informes de Gemini se leen como documentos académicos.

Ganador: chatgpt

Generación de imágenes

La generación de imágenes de ChatGPT impresiona independientemente de lo que solicite, incluso las indicaciones complejas para paneles o diagramas cómicos. No es perfecto, pero los errores y la distorsión son mínimos. Gemini genera imágenes visualmente atractivas más rápido que ChatGPT, pero rutinariamente incluyen errores y distorsión notables. Con indicaciones complicadas, especialmente diagramas, Gemini produjo resultados sin sentido en las pruebas.

Arriba, puede ver cómo ChatGPT (primera diapositiva) y Géminis (segunda diapositiva) les fue con el siguiente mensaje: “Genere una imagen de un estudio de moda con una decoración simple y rústica que contrasta con el espacio más agradable. Incluya un sofá marrón y paredes de ladrillo”. La imagen de ChatGPT limita los problemas al detalle fino en las hojas de sus plantas y texto en su libro, mientras que la imagen de Gemini muestra problemas más notables en su tubo de cordón y lámpara.

Ganador: chatgpt

¡Obtenga nuestras mejores historias!

Toda la última tecnología, probada por nuestros expertos

Regístrese en el boletín de informes de laboratorio para recibir las últimas revisiones de productos de PCMAG, comprar asesoramiento e ideas.

Al hacer clic en Registrarme, confirma que tiene más de 16 años y acepta nuestros Términos de uso y Política de privacidad.

¡Gracias por registrarse!

Su suscripción ha sido confirmada. ¡Esté atento a su bandeja de entrada!

Generación de videos

La generación de videos de Gemini es la mejor de su clase, especialmente porque ChatGPT no puede igualar su capacidad para producir audio acompañante. Actualmente, Google bloquea el último modelo de generación de videos de Gemini, VEO 3, detrás del costoso plan AI Ultra, pero obtienes más videos realistas que con ChatGPT. Gemini también tiene otras características que ChatGPT no, como la herramienta Flow Filmmaker, que le permite extender los clips generados y el animador AI Whisk, que le permite animar imágenes fijas. Sin embargo, tenga en cuenta que incluso con VEO 3, aún necesita generar videos varias veces para obtener un gran resultado.

En el ejemplo anterior, solicité a ChatGPT y Gemini a mostrarme un solucionador de cubos de Rubik Rubik que resuelva un cubo. La persona en el video de Géminis se ve muy bien, y el audio acompañante es competente. Al final, hay una buena atención al detalle con el marco que se desplaza, simulando la detención de una grabación de selfies. Mientras tanto, Chatgpt luchó con su cubo, distorsionándolo en gran medida.

Ganador: Géminis

Procesamiento de archivos

Comprender los archivos es una fortaleza de ChatGPT y Gemini. Ya sea que desee que respondan preguntas sobre un manual, editen un currículum o le informen algo sobre una imagen, ninguno decepciona. Sin embargo, ChatGPT tiene la ventaja sobre Gemini, ya que ofrece un reconocimiento de imagen ligeramente mejor y respuestas más detalladas cuando pregunta sobre los archivos cargados. Ambos chatbots todavía a veces inventan citas de documentos proporcionados o malinterpretan las imágenes, así que asegúrese de verificar sus resultados.

Ganador: chatgpt

Escritura creativa

Chatgpt y Gemini pueden generar poemas, obras, historias y más competentes. CHATGPT, sin embargo, se destaca entre los dos debido a cuán únicas son sus respuestas y qué tan bien responde a las indicaciones. Las respuestas de Gemini pueden sentirse repetitivas si no calibra cuidadosamente sus solicitudes, y no siempre sigue todas las instrucciones a la carta.

En el ejemplo anterior, solicité ChatGPT (primera diapositiva) y Gemini (segunda diapositiva) con lo siguiente: “Sin hacer referencia a nada en su memoria o respuestas anteriores, quiero que me escriba un poema de verso gratuito. Preste atención especial a la capitalización, enjambment, ruptura de línea y puntuación. Dado que es un verso libre, no quiero un medidor familiar o un esquema de retiro de la rima, pero quiero que tenga un estilo de coohes. ChatGPT logró entregar lo que pedí en el aviso, y eso era distinto de las generaciones anteriores. Gemini tuvo problemas para generar un poema que incorporó cualquier cosa más allá de las comas y los períodos, y su poema anterior se lee de manera muy similar a un poema que generó antes.

Recomendado por nuestros editores

Ganador: chatgpt

Razonamiento complejo

Los modelos de razonamiento complejos de Chatgpt y Gemini pueden manejar preguntas de informática, matemáticas y física con facilidad, así como mostrar de manera competente su trabajo. En las pruebas, ChatGPT dio respuestas correctas un poco más a menudo que Gemini, pero su rendimiento es bastante similar. Ambos chatbots pueden y le darán respuestas incorrectas, por lo que verificar su trabajo aún es vital si está haciendo algo importante o tratando de aprender un concepto.

Ganador: chatgpt

Integración

ChatGPT no tiene integraciones significativas, mientras que las integraciones de Gemini son una característica definitoria. Ya sea que desee obtener ayuda para editar un ensayo en Google Docs, comparta una pestaña Chrome para hacer una pregunta, pruebe una nueva lista de reproducción de música de YouTube personalizada para su gusto o desbloquee ideas personales en Gmail, Gemini puede hacer todo y mucho más. Es difícil subestimar cuán integrales y poderosas son realmente las integraciones de Géminis.

Ganador: Géminis

Asistentes de IA

ChatGPT tiene GPT personalizados, y Gemini tiene gemas. Ambos son asistentes de IA personalizables. Tampoco es una gran actualización sobre hablar directamente con los chatbots, pero los GPT personalizados de terceros agregan una nueva funcionalidad, como el fácil acceso a Canva para editar imágenes generadas. Mientras tanto, terceros no pueden crear gemas, y no puedes compartirlas. Puede permitir que los GPT personalizados accedan a la información externa o tomen acciones externas, pero las GEM no tienen una funcionalidad similar.

Ganador: chatgpt

Contexto Windows y límites de uso

La ventana de contexto de ChatGPT sube a 128,000 tokens en sus planes de nivel superior, y todos los planes tienen límites de uso dinámicos basados en la carga del servidor. Géminis, por otro lado, tiene una ventana de contexto de 1,000,000 token. Google no está demasiado claro en los límites de uso exactos para Gemini, pero también son dinámicos dependiendo de la carga del servidor. Anecdóticamente, no pude alcanzar los límites de uso usando los planes pagados de Chatgpt o Gemini, pero es mucho más fácil hacerlo con los planes gratuitos.

Ganador: Géminis

Privacidad

La privacidad en Chatgpt y Gemini es una bolsa mixta. Ambos recopilan cantidades significativas de datos, incluidos todos sus chats, y usan esos datos para capacitar a sus modelos de IA de forma predeterminada. Sin embargo, ambos le dan la opción de apagar el entrenamiento. Google al menos no recopila y usa datos de Gemini para fines de capacitación en aplicaciones de espacio de trabajo, como Gmail, de forma predeterminada. ChatGPT y Gemini también prometen no vender sus datos o usarlos para la orientación de anuncios, pero Google y OpenAI tienen historias sórdidas cuando se trata de hacks, filtraciones y diversos fechorías digitales, por lo que recomiendo no compartir nada demasiado sensible.

Ganador: empate

Related posts

Trending

-

Startups2 años ago

Startups2 años agoRemove.bg: La Revolución en la Edición de Imágenes que Debes Conocer

-

Tutoriales2 años ago

Tutoriales2 años agoCómo Comenzar a Utilizar ChatGPT: Una Guía Completa para Principiantes

-

Startups2 años ago

Startups2 años agoStartups de IA en EE.UU. que han recaudado más de $100M en 2024

-

Startups2 años ago

Startups2 años agoDeepgram: Revolucionando el Reconocimiento de Voz con IA

-

Recursos2 años ago

Recursos2 años agoCómo Empezar con Popai.pro: Tu Espacio Personal de IA – Guía Completa, Instalación, Versiones y Precios

-

Recursos2 años ago

Recursos2 años agoPerplexity aplicado al Marketing Digital y Estrategias SEO

-

Estudiar IA2 años ago

Estudiar IA2 años agoCurso de Inteligencia Artificial Aplicada de 4Geeks Academy 2024

-

Estudiar IA2 años ago

Estudiar IA2 años agoCurso de Inteligencia Artificial de UC Berkeley estratégico para negocios